Pharma

制药业破产的商业模式

by kelvin stott — on November 28, 2017 08:44 AM EDT

Updated: 08:56 AM

Like many industries, pharma

像许多行业一样

Various analysts (notably Deloitte and BCG) have tried to measure Big Pharma

很多分析师

A simple new method to measure R&D productivity / IRR

一种测算研发效率/内部收益率( )

Pharma

制药公司的业务模式主要包括对研发进行一系列的投入

Now we can greatly simplify this picture by considering only the average return on investment across the industry as a whole, which is what interests us in any case. We simply assume that all profits in any given year come from investments made within a single previous year, where the gap between these two years represents the average investment period, from the midpoint of R&D investment to the midpoint of returns at peak sales. As it happens, this average investment period is relatively stable and well-defined, as it is largely driven by a fixed standard patent term of 20 years, as well as a historically stable R&D phase lasting roughly 14 years from start to finish. Thus, the average investment period is about 13 years, from the midpoint of the R&D phase after 7 years, plus another 6 years to reach peak sales before loss of exclusivity.

现在我们可以通过仅考虑行业整体的平均投资回报率来大大简化这一情况

There is one potential argument against this method, which is that the later phases of R&D tend to cost many times more than the earlier phases. However, we must also remember that we need to invest in many more projects at the earlier phases than we invest in at the later phases, due to natural attrition within the R&D pipeline. Thus, the total R&D investment is actually distributed quite evenly throughout the development timeline. And, as I show below, the calculated return is not very sensitive to this single assumption in any case.

对这种方法

Before we use this simple method to calculate the return on investment, there is one more small but important detail to remember: The net return on R&D investment includes not only the resulting profits (EBIT), but also the future R&D costs. This is because future R&D spending is anoptional use of profits that result from previous investments.

在我们用这个简单的方法计算投资回报之前

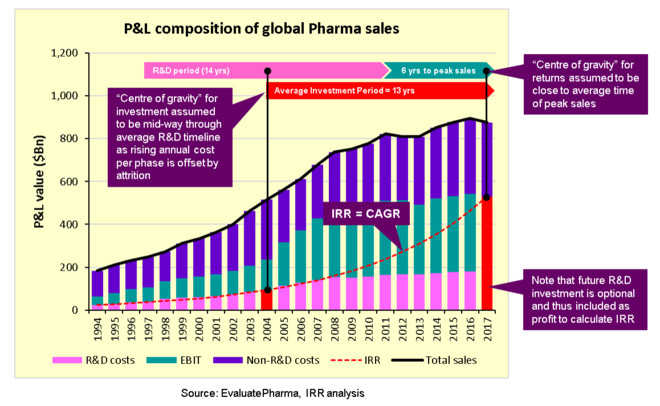

So now we can calculate the average return on investment (IRR) as the compound annual growth in the value of past R&D investments to the value of resulting profits (EBIT) plus future R&D costs, as illustrated here with industry P&L data from EvaluatePharma:

因此

Now we get the following simple formula to calculate the Internal Rate of Return (IRR) on pharma R&D in any given year x:

现在我们得到以下一个简单的公式来计算任何一年制药企业研发的内部收益率

IRR(x) = [ (EBIT(x+c) + R&D(x+c)) / R&D(x) ]^(1/c) - 1

Where c is the average investment period of 13 years.

其中c是平均投资期13年

Return on investment in pharma R&D is rapidly declining

新药研发的投资回报正在迅速下降

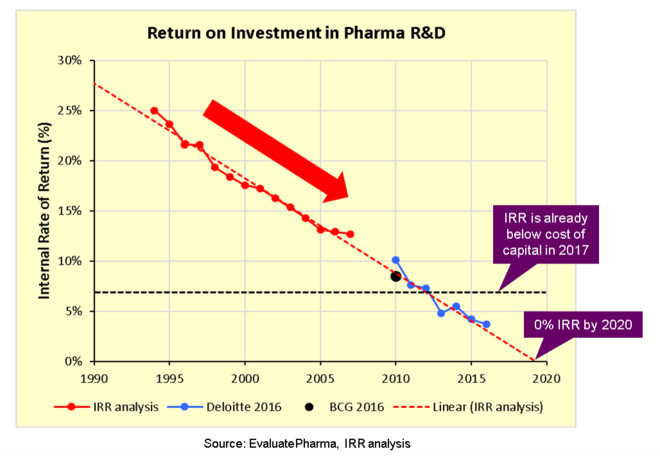

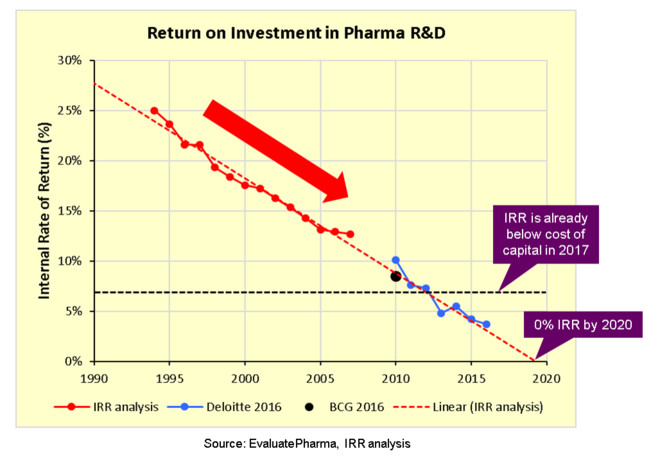

Applying this simple formula across multiple years of P&L data from EvaluatePharma, we see the following downward trend, which is fully consistent with reports published by both Deloitte and BCG:

应用这个简单的公式去拟合由EvaluatePharma汇总的多年损益数据

Now the scariest thing about this analysis, is just how robust, consistent and rapid is the downward trend in return on investment over a period of over 20 years. But moreover, these results confirm that return on investment in pharma R&D is already below the cost of capital, and projected to hit zero within just 2 or 3 years. And this despite all efforts by the industry to fix R&D and reverse the trend.

从这个分析中看到的最可怕的事情是

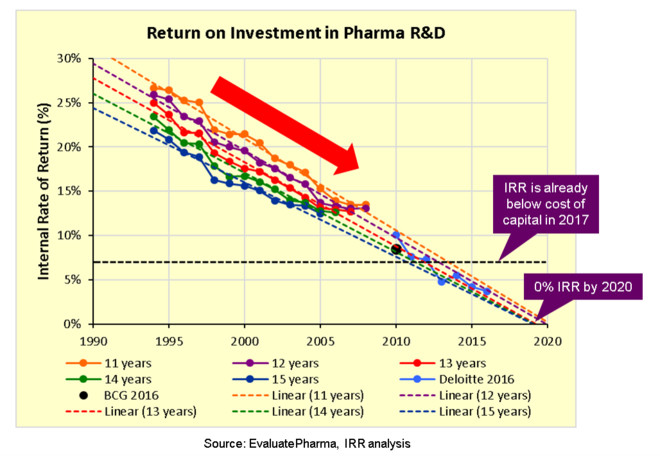

I mentioned earlier that this analysis is based on one assumption, the average investment period which is quite stable and well-defined, but here below we see that the results are not sensitive to this single assumption in any case. The downward trend is just as clear, as is the projected IRR of 0% by 2020:

我在前文提到

So what is driving this trend, and why haven

那么是什么推动了这个趋势呢

Law of Diminishing Returns

边际效益递减规律

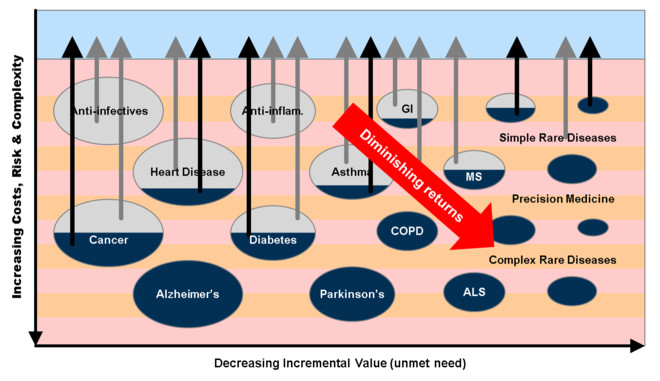

Many different causes and drivers have been suggested to explain the steady decline in pharma R&D productivity, including rising clinical trial costs and timelines, decreasing success rates in development, a tougher regulatory environment, as well as increasing pressure from payers, providers, and increasing generic competition, however there is one fundamental issue at play that drives all these factors together: The Law of Diminishing Returns.

有许多不同的原因可以用来解释新药研发效率稳定的下降趋势

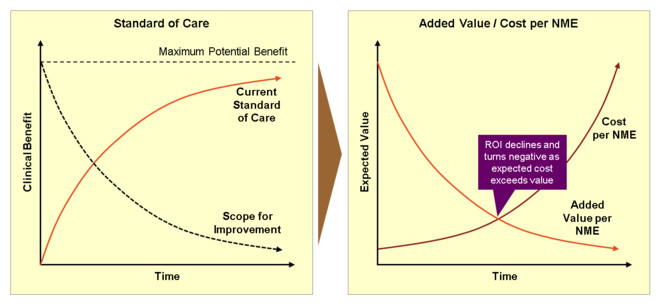

As each new drug improves the current standard of care, this only raises the bar for the next drug, making it more expensive, difficult and unlikely to achieve any incremental improvement, while also reducing the potential scope for improvement. Thus, the more we improve the standard of care, the more difficult and costly it becomes to improve further, so we spend more and more to get diminishing incremental benefits and added value for patients which results in diminishing return on investment, as illustrated here:

由于每一种新药都提高了当前的标准

But why does the analysis above suggest a linear decline that will hit 0% IRR by 2020? Shouldn

但为什么上面的分析显示

No. 0% IRR corresponds to breaking even and getting exactly your original investment back, but as anyone who has worked in pharma will know all too well, you can easily lose all your original R&D investment as most drugs fail without making any return at all, so the minimum theoretical IRR is in fact negative 100%. There is no reason why the IRR should stop declining before it reaches 0%, or even -100%, besides the limited patience of investors.

不

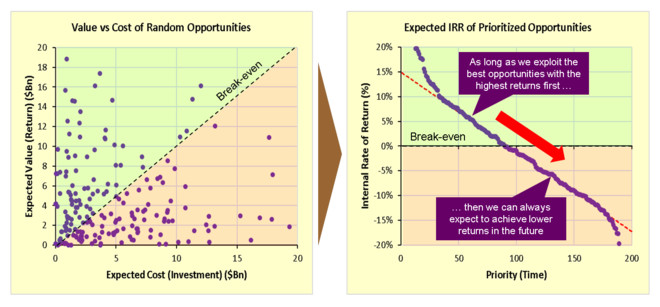

To further illustrate how the Law of Diminishing Returns applies to pharma R&D, let us consider a limited set of 200 potential drug development opportunities defined by a random exponential distribution of expected costs (investments) yielding an independent random exponential distribution of expected values (returns) after an average investment period of 13 years. The expected IRR of each opportunity is given by the formula:

为了进一步说明边际效益递减规律如何作用在制药企业的研发中

IRR = [ eReturn / eCost ] ^(1/13) - 1

Now we rank and prioritize all these potential opportunities by their expected IRR over time, just as we select and prioritize drug development projects by their expected return on investment in the pharma industry, and this is what we get:

现在

Notice how the midsection of the IRR plot of prioritized opportunities follows a perfectly linear downward trend that passes right through 0% IRR, which is exactly what we have seen with our analysis of pharma R&D productivity above! The implications of this are rather striking:

请注意

Return on investment in Pharma R&D is declining because that is precisely how we prioritize investment opportunities over time.

制药企业研发投资回报正在下降

In essence, drug discovery is rather like drilling for oil, where we progressively prioritize and exploit the biggest, best, cheapest and easiest opportunities with the highest expected returns first, leaving less attractive opportunities with lower returns for later. Eventually, we are left spending more value than we are possibly able to extract:

本质上

Implications and projections for the pharma industry

对制药行业的启示和预测

Now given that the steady decline in return on investment in pharma R&D follows the Law of Diminishing Returns as the natural and unavoidable consequence of how we prioritize R&D investment opportunities, where does that leave the industry?

考虑到制药企业研发的投资回报率的稳定下滑遵循着边际效益递减规律

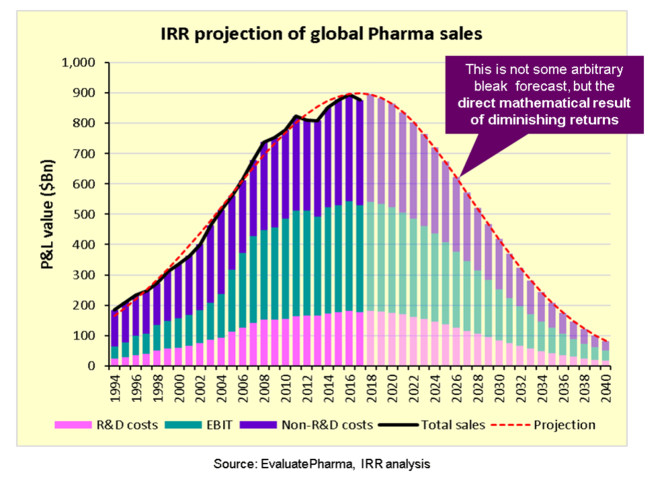

We can simply extrapolate the robust linear downward trend in IRR, and then apply the same formula we used above to calculate IRR based on past performance in reverse, to predict how the industry will evolve in the future. This is what we get:

我们可以简单地把内部收益率稳定的线性下降趋势进行外推

Wow! What we see is that the entire pharma industry is on the brink of terminal decline, and will already start to contract within the next 2 or 3 years!

喔

This seems incredible, but remember that this is not some arbitrary bleak forecast. It is the direct mathematical result of the Law of Diminishing Returns which we have already seen in our analysis above, and which we have been able to exactly replicate by prioritizing a limited set of random investment opportunities.

这似乎不可思议

So what is going on here? Can this really happen?

那么

Pharma’ s broken business model

制药业破产的商业模式

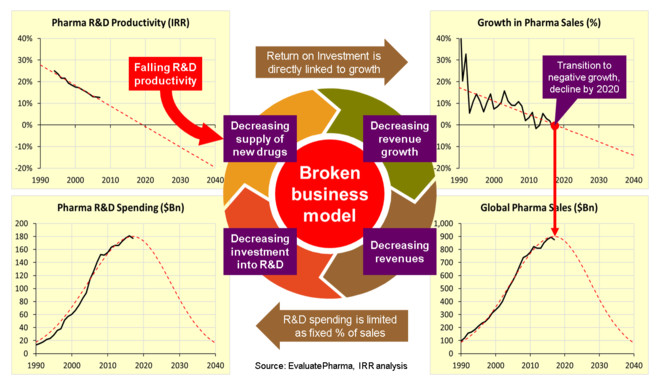

The situation is illustrated nicely by this schematic here below:

下面的示意图很好地说明了这种情况

What we have here is an industry that is entering a vicious cycle of negative growth and terminal decline as its fundamental business model has run out of steam by the Law of Diminishing Returns: Diminishing R&D productivity and return on investment leads to diminishing growth in sales. Eventually, growth turns negative and sales start to contract. Reduced sales then reduces the amount of money available to invest back into R&D, which causes sales growth to decline even further. And so on, until the industry is gone altogether.

我们所看到的是一个正在进入恶性循环中的行业

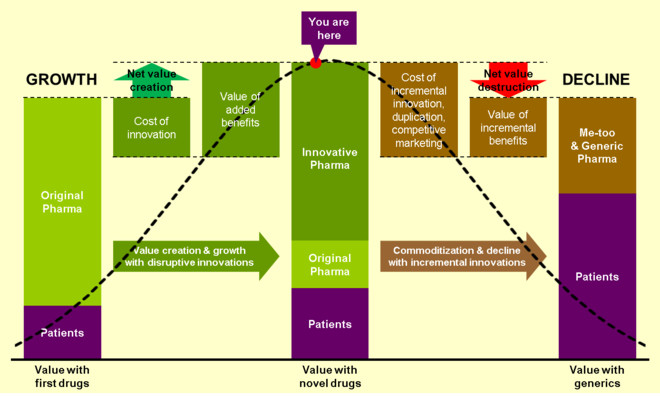

This principle is further illustrated here, showing how value creation is turning negative:

下图进一步展示了这个原理

Industry life cycles and regeneration

行业的生命周期和重生

So can this happen? Will pharma really shrink out of existence, and is there anything we can do to stop it?

那么这会发生吗

In short, yes, it can and will happen. Pharma as we know it will shrink out of existence, and no, there is nothing we can do to stop it. We know this because the steady decline in IRR is an unavoidable consequence of prioritization, and has continued despite all our efforts to slow, stop and reverse the decline to date.

简而言之

We should not be surprised by this. All industries and business models follow the Law of Diminishing Returns, and many industries have come and gone through history. In fact, the Pharma industry itself sprouted out from the terminal decline of the chemicals and dye industry as it was slowly commoditized. Out of the ashes grows the new.

我们不应该为此感到惊讶

And therein lies the only real hope for the pharma industry — or at least the companies and hundreds of thousands of people working within it.

这是制药行业的唯一真正的希望

Just as the pharma industry evolved from the chemicals industry, and the biopharma industry has evolved from the pharma industry, the pharma and biopharma industries together will evolve into something quite different, most likely continuing the historic trend of increasing complexity towards more complex biological solutions to pressing healthcare problems, such as cell & gene therapy, tissue engineering and regenerative medicine:

正如制药行业从化学工业衍生出来

But who really knows?

但谁又真正知道呢

What is clear is that pharma (and biopharma) will not be around forever, and Darwin

清晰的现实就是制药

It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change.

生存下来的不是最强壮的物种

Indeed. Adapt or die!

确实如此

原文链接

译者

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号