Pharma

制药业破产的商业模式-第二部分

by kelvin stott — on May 2, 2018 01:13 PM EDT

In Part 1 of this blog, I introduced a simple robust method to calculate Pharma

在这篇博客的第一部分

Here in Part 2, I explore the mathematical relationship between R&D productivity, IRR and past and future P&L performance in more detail. In particular, I show how the linear decline in IRR actually corresponds to an exponential decline in nominal Return on Investment (ROI) as a more direct measure of R&D productivity, which then leads directly to terminal decline in future P&L performance. I then use this model to run some what-if scenarios, to explore how much we will need to improve nominal R&D productivity/ROI in order to maintain positive P&L growth. The results show that we need a major breakthrough right now, in 2018, and even then we will face a period of significant contraction before any recovery, while anything less would be too little, too late to save the industry from terminal decline.

在第二部分

Finally, I identify the single limiting factor that is ultimately responsible for driving the decline in R&D productivity by the Law of Diminishing Returns, and I explain why many of Pharma

最后

Nominal ROI as a direct measure of R&D productivity

名义投资回报率作为研发效率的直接测量指标

In Part 1, I showed that Pharma

在第一部分

IRR(x) = [(EBIT(x+c) + R&D(x+c)) / R&D(x)]^(1/c) - 1

Where c is the industry average investment period of 13 years, from an initial R&D investment to the resulting commercial returns.

在这里c是行业内的平均投资期

Moreover, I showed that Pharma

不仅如此

IRR(x) = -0.00912*(x-2020)

This means that Pharma

这意味着

The IRR defines an effective interest rate that provides a more complete and accurate measure of return on investment over time, but R&D productivity is best defined and more easily understood as a simple efficiency ratio. In particular, the nominal Return on Investment (ROI) in any year x measures the absolute nominal value of commercial returns vs original R&D investment over the average investment period c:

内部收益率定义了一个有效的回报率

ROI(x) = (EBIT(x+c) + R&D(x+c)) / R&D(x)

As explained in Part 1, note that the ultimate commercial returns include not only EBIT, but alsofuture R&D spending as an optional use of profits that result from the original R&D investment.

如第一部分的解释

Now, by substituting this equation into the original formula for IRR above, we can see that IRR is directly related to the nominal ROI as follows:

现在

IRR(x) = ROI(x)^(1/c) - 1

And conversely:

然后反过来

ROI(x) = [1 + IRR(x)]^c

Finally, by substituting the historic linear trend above into the IRR term of this equation, and the industry average investment period of 13 years into the cterm, we get the following formula, which shows that nominal R&D productivity/ROI currently stands at about 1.2 (i.e., we get only 20% back on top of our original R&D investment after 13 years), is declining exponentially by about 10% per year, and will hit 1.0 (zero net return on investment) by 2020:

最后

ROI(x) = [1 - 0.00912*(x-2020)]^13 ≈ 0.899^(x-2020)

This result is consistent with an earlier report by Scannell et al., which shows that Pharma R&D productivity (in terms of NMEs per $Bn R&D spend) has been declining exponentially by about 7.4% per year since 1950 (99% over 60 years). Note that the 2.6% difference in the annual rate of decline must be explained by a decline in the average commercial value per NME, most likely due to diminishing incremental benefit as each new drug raises the bar and reduces the scope for improvement by the next, as well as increasing competition from generics and me-too drugs.

这个结果以之前Scannell等人的报告一致

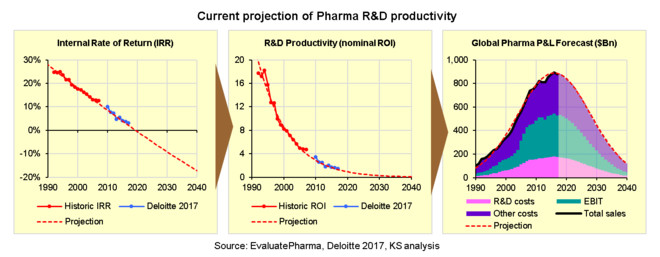

The direct mathematical relationship between IRR, nominal R&D productivity/ROI, and both past and future P&L performance is illustrated in the following 3 charts. Note that the trends represented by red dotted lines in each chart are all fully consistent with each other according to the formulae above, and fit closely with the historic P&L data as well as recent IRR estimates from Deloitte.

内部收益率

Now we can see clearly, in real terms, just how fast R&D productivity has been declining.

现在我们可以清晰地看到

Furthermore, we can now use these formulae to predict the impact of improving nominal R&D productivity/ROI on future P&L performance, either by continuous improvement or by making major technology breakthroughs, in order to determine just how much improvement is required to maintain positive P&L growth and avoid terminal decline.

不仅如此

Impact of continuous improvement in R&D productivity

研发效率的持续渐进式的提升的影响

The ultimate goal of continuous improvement is to improve overall R&D productivity over an extended period of time, either by increasing the number or commercial value of new approved drugs, or by decreasing the R&D investment required to develop each new drug, or possibly a combination of both. In any case, change is slow and efficiency is improved only gradually by small amounts each year over many years.

持续渐进式的改进的最终目标是在较长时期内提高整体研发效率

So by how much do we need to increase nominal R&D productivity/ROI each year in order to maintain positive P&L growth and avoid terminal decline? Is it 5%, 10%, 15% or even 20%? And by when do we need to start making these annual improvements? Has anyone even asked these questions before?

那么

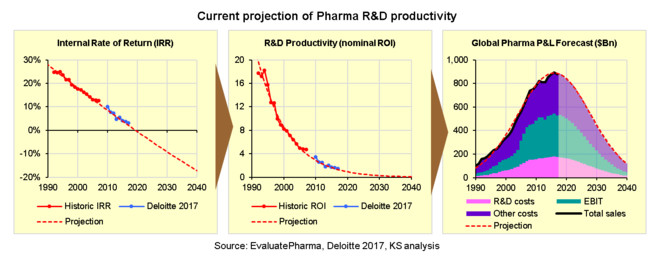

Before we use the formulae above to calculate the impact of continuous improvement on future P&L performance, consider that any improvements must be applied to the current baseline. In other words, we must counteract the current annual decline in R&D productivity before we can start increasing overall R&D productivity in absolute terms. On that basis, the expected impact of consistently improving nominal R&D productivity/ROI by 5%, 10%, 15% or 20% each year from 2018 is shown in the following charts:

在我们使用上述这些公式去计算持续渐进式的提升对未来损益表现的影响之前

What we can see is that improving R&D productivity by 5% or even 10% each year from 2018 would slow, but not reverse the current decline in nominal ROI and IRR. Moreover, it would make virtually no difference to the projected terminal decline in P&L performance. Even a 15% annual increase in R&D productivity would barely be enough to avoid terminal decline, and the industry

我们能看到的是

In fact, we would need to increase nominal R&D productivity/ROI by at least 20% each year to reverse the projected decline in P&L performance, and even then, the industry

事实上

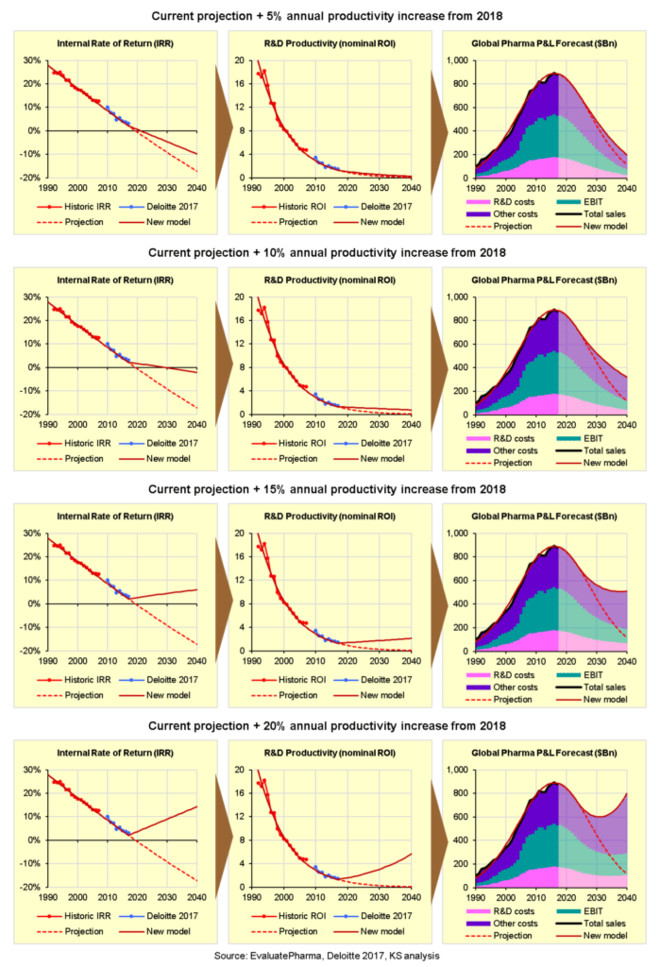

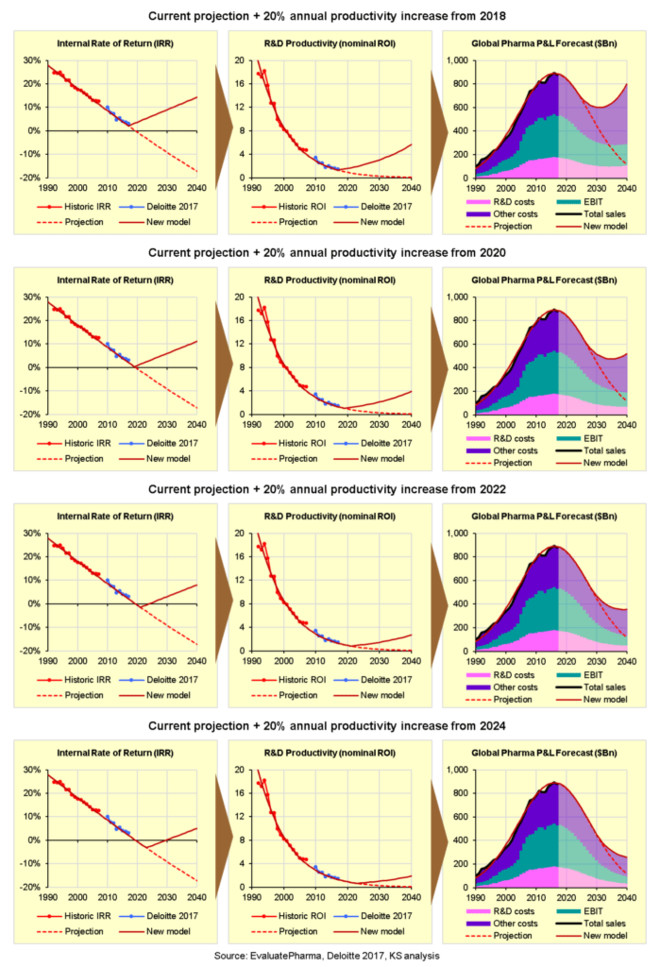

So by when do we need to start making these annual improvements? The charts below show the impact of improving nominal R&D productivity/ROI by 20% per year from 2018, 2020, 2022 or 2024:

那么

In short, we need to start improving nominal R&D productivity/ROI by 20% per year right now, from 2018, because the longer we wait the less impact it will have to avoid terminal decline.

简而言之

A 20% sustained annual increase in R&D productivity is a very high target indeed, which would require increasing the number or average commercial value of new approved drugs by 20% each year, or decreasing the R&D investment required to develop each new drug by 20% per year. So is it achievable? Could any, or even all of Pharma

研发效率每年持续20%的增长确实是个非常高的目标

I will leave this question open for readers to reflect, meanwhile let us now consider the potential impact of a major breakthrough in R&D productivity.

我将这个问题留给读者反馈

Impact of a major breakthrough in R&D productivity

研发效率的重大突破的影响

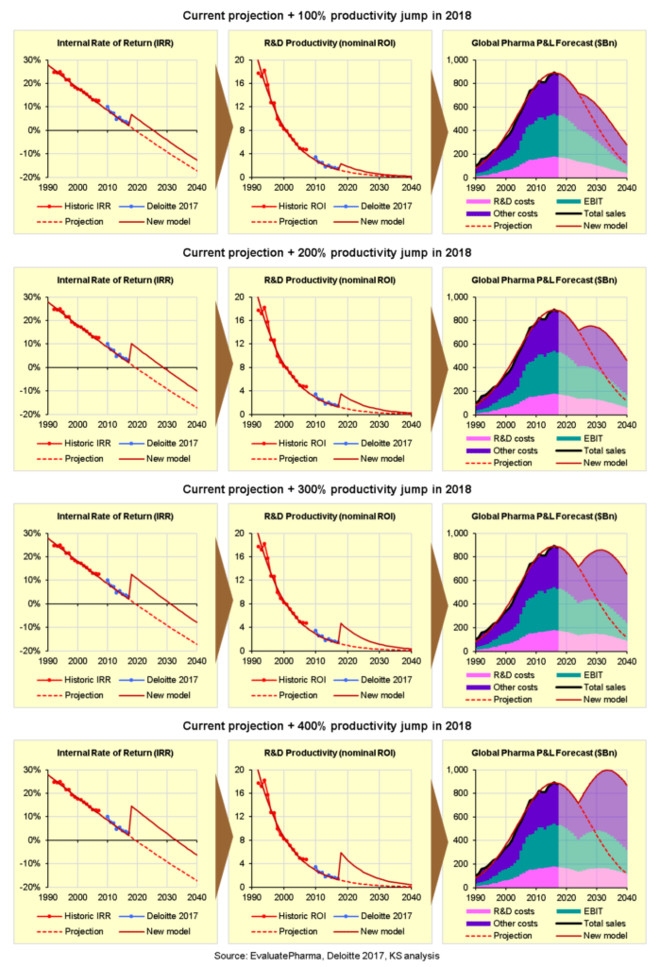

Unlike continuous improvement, which requires making incremental annual improvements in R&D productivity over many years, new technologies have the potential to make a significant impact on R&D productivity within a short timeframe, and possibly even within a single year. Now, we have seen many breakthrough technologies in drug discovery over the years, and not one of these has made any difference to the rapid and steady decline in R&D productivity, but still let us consider: What if we could improve R&D productivity now in 2018 by 100%, 200%, 300%, or even 400%? What would be the impact on projected P&L performance?

持续渐进式的提升需要持续多年

Before we run the calculations, we must consider that a major breakthrough may provide a one-time jump in R&D productivity from the current baseline, but R&D productivity would then continue to decline at the current rate of 10% per year because no improvement is sustainable in the long term due to the Law of Diminishing Returns. On that basis, the impact of increasing nominal R&D productivity/ROI by 100%, 200%, 300% or 400% is shown in the charts below:

在我们计算之前

Here we can see that a 100% increase (two-fold improvement) in R&D productivity would delay the tail end of terminal decline by only 5 years, while a 200% increase (three-fold improvement) would delay terminal decline by about 10 years, but would not avoid it, and the industry

我看可以看出

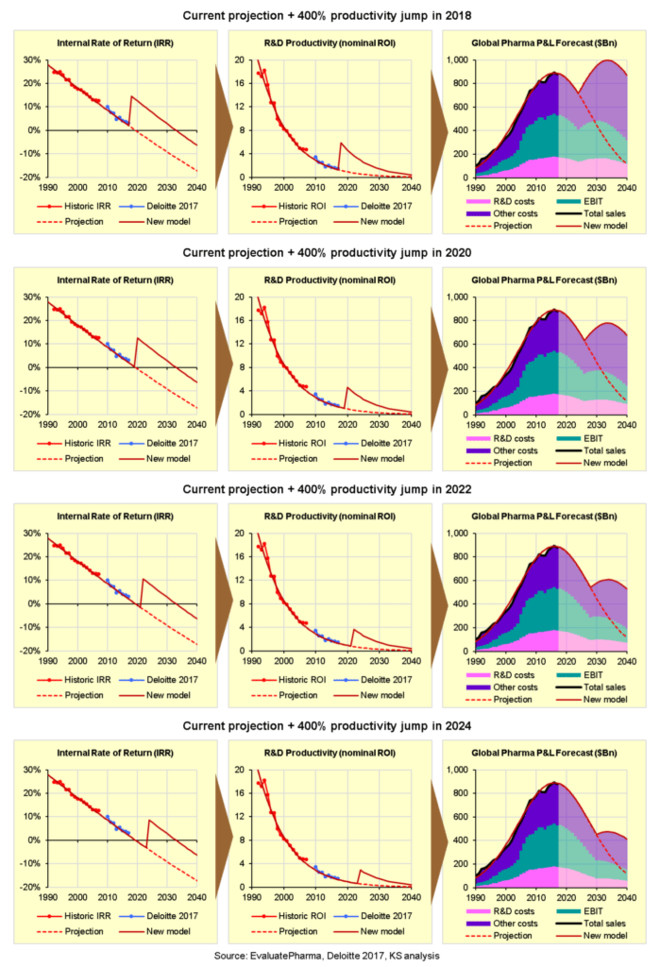

I will discuss below how we might be able to achieve such a breakthrough in R&D productivity, but assuming we could increase R&D productivity by 400%, by when would we need to achieve it? How much time do we have left to develop and implement such a breakthrough?

我将会在后面探讨我们如何做才有望在研发效率上取得突破

The following charts show the expected impact of increasing nominal R&D productivity/ROI by 400% in 2018, 2020, 2022, or in 2024:

下面这些图分别展示了在2018

Here again, the bottom line is that we need a major breakthrough right now, in 2018, because the longer we wait the less impact it will have to save the industry from terminal decline.

这些图又一次显示

Now, in order to evaluate how we might achieve this, we need to take another look at the Law of Diminishing Returns to understand exactly what is driving this trend so that we can finally figure out how to address the underlying issue.

现在

Another look at the Law of Diminishing Returns

重新审视边际效益递减规律

In Part 1 of this blog, I showed that the linear decline in IRR can be fully explained by the Law of Diminishing Returns as a natural and unavoidable consequence of prioritizing a limited set of investment opportunities. In particular, I demonstrated that prioritizing a limited set of random investment opportunities by their IRR over time produces a perfect linear decline in IRR, which passes right through 0%, exactly as we have seen with Pharma

’

s R&D productivity. Moreover, the IRR plot of prioritized investment opportunities follows a perfect linear decline regardless of their initial distribution.

在这篇博客的第一部分

In fact, the only condition required to guarantee that a sequence of investments follows the Law of Diminishing Returns in this way, is that the total number and/or potential value of investment opportunities is ultimately limited. In essence, there must be some critical limiting factor, which is both exhaustible and in short supply.

实际上

So what could be the ultimate limiting factor in Pharma R&D? It is certainly not the number of potential new drugs itself, since the number of possible drug-like molecules has been estimated to exceed the number of atoms in the entire solar system.

所以

And it is not the unmet clinical need or potential value of new drugs, since we spend more each year on healthcare for our growing and ageing population. Indeed, there appears to be no end to human suffering, and we will always get sick and die at least once in our lives, despite medical progress.

这也不是未满足的临床需求或新药的潜在价值的问题

The real answer, as I explain below, is that we are rapidly running out of viable new drug targets that could possibly be addressed with existing approaches and technologies.

真正的答案

A diminishing pool of viable new drug targets

可用的新药靶点日渐减少

Ultimately, all drugs work by interacting with at least one specific molecule or

“

drug target

最终

1. Clear correlation or relationship with human disease

2. Can be targeted with small molecules or large proteins

3. Not already exploited by existing approved drugs

4. Not already tested and failed due to mechanism of action

5. Commercially viable, linked to a clear unmet need

1. 与人类疾病的清晰关系或联系

2. 能被小分子或大的蛋白质所靶向

3. 尚未被已获批准的药物所使用

4. 作用机制未被此前的测试证明为失败

5. 商业上可行

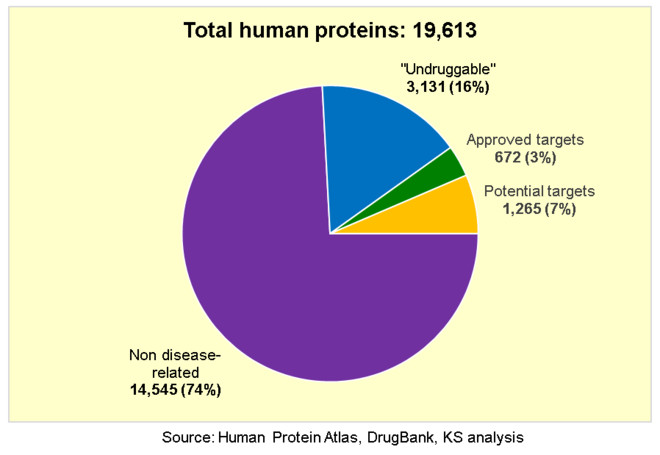

According to the Human Protein Atlas, there are 19,613 proteins encoded by the human genome. Of these, 14,545 (74%) have no known link or relationship with disease, which rules them out as potential new drug targets because they fail to meet criterion 1 above. Perhaps these proteins are non-essential, as any deficiencies can be compensated by other proteins or pathways; or perhaps they are essential, however any deficiencies are lethal before birth so they never have the chance to cause any disease. In any case, we have no reason to believe that targeting these proteins will do anything for any known human disease.

根据

Now of the 5,068 proteins that have any link to disease, 3,131 (16% of all human proteins) are considered to be

这样

This leaves only 1,937 potential drug targets (10% of all human proteins), but 672 of these have already been fully exploited as proven drug targets by current approved drugs. Once a new drug target is first identified and exploited by an original first-in-class drug, any

这样排除后

So now we are left with only 1,265 potential new drug targets:

算到现在

At first glance, it seems that we have more than twice as many potential new drug targets left to find and exploit as those we have already exploited, so we should not be overly concerned about running out any time soon. But what about the other two criteria, 4 and 5? How many of these potential drug targets have already been tested but failed to yield any drugs due to mechanism of action? How many have not yet been tested, but are still unlikely to yield any drugs? And how many will yield only drugs that are not commercially viable in any case?

初看上去

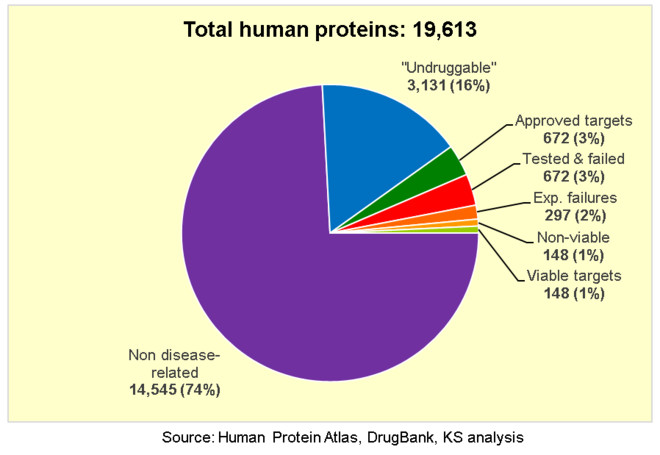

Now this is where the numbers get a bit fuzzy because they are not widely reported (or at least I could not easily find them), but we can make some very rough estimates.

现在这个数字比较模糊

First, let

首先

Now we are left with only 296 potential drug targets, but how many of these will produce drugs that are commercially viable? It has been estimated that only about 25% of new approved drugs manage to fully recover their own R&D costs and make any commercial return. Many of those that fail commercially are me-too drugs that compete for the same drug target, but many are also novel first-in-class drugs that compete with other drugs acting by different mechanisms to target the same disease, or that target diseases with insufficient clinical need.

现在

So let

所以

Again, this is just a rough estimate based on some crude assumptions, but still it is clear that we are rapidly running out of viable new drug targets that meet all 5 criteria above. We are literally scraping the barrel for the last remaining drug targets, and chances are we are already working on all these remaining targets in direct competition with each other. Now is it really any wonder that R&D productivity has been declining so rapidly by the Law of Diminishing Returns?

再次申明

Limited potential impact of Pharma’ s current strategies

有限的潜在机会对制药企业当前策略的影响

Given that we are rapidly running out of viable new drug targets, it is easy to see why Pharma

’

s R&D productivity has been declining so rapidly by the Law of Diminishing Returns. Moreover, it is easy to see why none of Pharma

鉴于我们正在高速消耗所剩无几的新药靶点

Almost all of Pharma

几乎所有的制药企业以往及当前的策略都是用下述方法中的一种或多种来提升研发效率

1. Increase the efficiency by which we identify viable new drug targets that meet all 5 key criteria listed earlier

2. Increase the efficiency by which we identify safe and effective new drugs against those targets identified in 1 above

3. Increase the quality and expected commercial value of those drugs identified in 2 above

1. 通过筛选出同时满足上述所有5项条款的新药靶点来提升效率

2. 针对符合第1条的靶点

3. 提升符合第2条的药物的质量及其期望商业回报

For example, molecular biology, genomics, proteomics and bioinformatics have been developed to increase the efficiency of target discovery by improving our understanding of human biology and disease, while other technologies like rational drug design, cheminformatics, combinatorial chemistry and high throughput screening have been developed to increase the efficiency of drug discovery by exploring new chemical space. Meanwhile, open innovation and in-licensing have been developed to source new drugs and technologies more efficiently than internal innovation. Precision medicine with biomarkers and real-world evidence has been developed to increase the clinical benefit and commercial value of new drugs in specific patient populations. Now there is a big push with big data, machine learning and AI to make significant improvements in all these areas. And of course, continuous improvement has been Pharma

例如

Note that none of these strategies can increase the overall number of viable new drug targets that meet the 5 key criteria above. Instead, they are simply designed to exploit the remaining pool of viable new drug targets more efficiently, which ironically, will only accelerate its depletion.

注意

These strategies have not worked, and will not work, because they do not address the underlying issue: We are rapidly running out of viable new drug targets that can be targeted by classic small molecule drugs or large therapeutic proteins.

这些策略并没有奏效

So how can we address this problem to improve R&D productivity?

那么

An alternative approach to improve R&D productivity

一条提升研发效率的替代路径

Ultimately, the only way we can break free from the Law of Diminishing Returns is to increase the number of viable new drug targets; and the only way we can do this is to remove or relax at least one of the 5 key criteria listed earlier.

最终

,

我们摆脱边际效益递减规律的唯一途径是增加可行的新药靶点数量; 我们实现这一点的唯一方法是去掉或放松前述的5项关键条款中的至少一项

At first, it seems that all these criteria are absolute critical requirements for any new drug target. For example, if there is no clear link with human disease, or if there is no clear unmet need, then there is no viable drug target. Furthermore, if we have already tested a drug target and it failed for safety reasons, or if we have already fully exploited it with existing approved drugs, then we cannot exploit it further. And finally, if we can

初看上去

Or can we? Are we really limited to using small molecules and large proteins as drugs to target specific proteins and treat diseases more generally?

我们真的不能吗

Small molecules have the great benefit that they can penetrate cell membranes to reach potential drug targets within the cell, but on the other hand, they require a clear binding pocket within the target protein, otherwise they have the wrong size and shape to bind effectively and specifically to flat protein surfaces. Meanwhile, large therapeutic proteins such as antibodies can form much stronger, more specific interactions with such flat protein surfaces, but they are generally unable to penetrate cell membranes and get into the cell. Thus by limiting our potential drug repertoire to small molecules and large proteins, we are effectively limiting our pool of potential new drug targets to extracellular proteins, or intracellular proteins that have a clear binding pocket. At the moment, we have no means to target intracellular proteins that have no clear binding pocket, yet there are thousands of these

小分子可以穿透细胞膜以进入细胞内潜在的靶点

According to the Human Protein Atlas, 3,131 (about 16%) of all proteins encoded by the human genome are

根据

First, it is clear that small molecules do not have the size and shape required to bind effectively and specifically to large and flat protein surfaces. They are simply unable to compete with the tight and specific binding that occurs between different protein molecules within the cell, which is why we have never been able to develop an effective small molecule inhibitor of any known protein-protein interaction. Therefore, we are forced to use large molecules in order to compete effectively with these strong interactions, but this leaves us with the other problem: How to get such large molecules into cells in the first place?

首先

If only we could find a reliable way to get large molecules into cells, then we could potentially target thousands of different proteins and protein-protein interactions that are currently beyond reach within the cell. So again, how to achieve this?

如果我们能找到一种可靠的办法来让这些大分子进入细胞

The cell membrane is notoriously difficult to penetrate, especially by large molecules, but nature has shown that it can be done. For example, several large macrocyclic antibiotics and bacterial toxin proteins are known to cross the cell membrane. So can we adapt these molecules to act as drugs once they get into the cell? Or better still, can we understand how they get into cells in the first place and apply these principles to design a whole new class of cell-penetrating therapeutic proteins that could be adapted to bind tightly and specifically to any target protein in the cell? I have my own specific ideas that I would like to pursue in this regard, but hopefully it is clear by now that getting large molecules into cells is perhaps the only way to address the real underlying issue of declining R&D productivity. This problem is too important to rely on just one idea, so we need to pursue as many potential solutions as possible, in order to reverse the decline in R&D productivity and save the industry from terminal decline, before it is too late.

细胞膜非常难以穿透

In summary, Pharma R&D productivity is declining by the Law of Diminishing Returns because we are rapidly running out of viable new drug targets that can be intercepted by small molecules or large proteins. None of Pharma’s past or current strategies to improve R&D productivity has worked because they do not address the underlying issue, and the only way to solve this problem is to develop completely new modalities that can address currently “undruggable” targets within the cell.

总之

It is still not too late, but time is running out very fast.

现在仍然还不算太晚

原文链接

译者

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号